Have you read any Colonial Penn $9.95 Life Insurance reviews or just getting started? Wondering if the Colonial Penn $9.95 plan is the best thing since sliced bread?

With our reviews, you will always hear our expert opinion on why a particular company and/or product is a good policy offering or not.

We’re going to pick apart the life insurance from Colonial Penn and let you decide whether it is a good alternative for you or not.

To preface this Colonial Penn $9.95 plan review, there is no best company, particularly when you have a medical history that comes with aging.

Since “best” is really a moving target, what you will hear is how a Colonial Penn policy compares to the wealth of other life insurance carriers in terms of benefits, cost and value.

Without further ado…

Company Profile

Part of the CNO Financial Group of companies, Colonial Penn is a sister company to Bankers Life and Casualty based out of Pennsylvania.

The company offers a life insurance product requiring “no-exam.” This means your application for coverage requires no visits from a nurse to draw blood, urine testing, blood pressure check, etc.

$9.95 Life Insurance From Colonial Penn: The History

Many of us who have been around the block and watched TV for many years have heard of Colonial Penn. Lots of name familiarity right? Plenty of commercials over the years.

At one time there was Ed McMahon and later came Joe Theismann (Under the name Conseco Life). In recent years, Alex Trebek, of Jeopardy has been the paid spokesman testifying what a great company Colonial Penn is. In 2020, Mr. Trebek passed away after battling Pancreatic Cancer. As you read this article, please understand it was originally written a few years prior and has been updated in a few places along the way to reflect changes that have been made by the insurance company, Colonial Penn. The death of Mr. Trebek has no bearing on this insurance product…the benefits or cost.

With that said…

Too often, we as consumers get caught up in all the glitz that a high paid, celebrity endorser can bring to an advertisement.

Let’s clear the slate so to speak…

and…

Remove the fancy wrapping paper and breakdown the product this insurance company offers consumers.

The 9.95 life insurance commercial from Colonial Penn has put a spin on an old product offered by a few different life insurance companies.

Advertisements having nothing to do with quality of coverage, rates/affordability, handling of claims and other important considerations.

To interpret our review of this insurance company, you must put aside all of this to discover whether Colonial Penn life insurance will be the best fit for you and your family. The wrong policy could leave your family in a mountain of debt if your final day comes comes unexpectedly.

Disclaimer – We have no business relationship with Colonial Penn. Special Risk Life is an independent life insurance agency offering dozens of life insurance carriers around the United States. Our review is meant to give you comparison information only. If you would like to contact Colonial Penn, their phone number is 877-877-8052.

Basics Of The $9.95 Colonial Penn Plan

Colonial Penn’s life insurance policy is designed for shoppers age 50 to 85 (in most states) who only need a lifetime plan but only a small amount of coverage. It accepts very high risk applicants who can not qualify for better no exam whole life insurance elsewhere.

How does this policy accept people in very poor health? Colonial Penn inserts a limited benefit period clause into this policy. What that mean is the $9.95 life insurance has limited protection the first 2 years of ownership for all natural causes of death.

Coverage like this is commonly used to pay for end of life expenses.

The intent of a typical policy owner of Colonial Penn’s $9.95 burial insurance is to see that their loved ones are not burdened financially upon their inevitable death.

The no exam, Colonial Penn $9.95 whole life insurance is sometimes called final expense insurance as well.

A nice feature of no exam whole life insurance is the availability of smaller policy amounts. Most people 50-85 do not purchase final expense policies beyond 50K. Protecting family members from the high cost of funeral and burial costs are the most common use of the 9.95 plan.

Like other whole life insurance coverage, the money from this policy can be used on any purpose your loved ones would need it for.

The $9.95 Plan Quiet Kept Secrets

As of 2024, Colonial Penn only offers their only their $9.95 plan. Yes, only 1 option led by company executive, Jonathan Lawson. This policy may or may not be adequate for covering all final expenses associated with one’s passing depending upon your age at application. In the past, they have had other options.

Beyond the increased cost of insurance from CP, you must consider the possible effect on your beneficiary before buying any 9.95 life insurance. Remember the 2 year limited benefit period? Is the policy death benefit enough to cover their needs if you pass sooner than expected?

If you do not fully understand, be sure to talk to a professional to get a complete understanding the inherent problems with guaranteed acceptance life insurance. Too many times, we receive phone calls from families who had a bad experience and didn’t get paid out enough to fund the cost of the funeral.

So, why would a consumer purchase a Colonial Penn 9.95 plan in the first place?

Well, most often, it is due to name recognition, ease of application and emotion. Colonial Penn has created a simple way of obtaining a policy. Approval is easy and more forgiving when compared to whole life insurance that asks a few health questions. We all remember Alex Trebek’s “Guaranteed Acceptance.” Colonial Penn is a name brand most adults are very familiar with.

Again…

Guaranteed Acceptance coverage is probably not in your best interest roughly 85% of the time. This is regardless of the insurance company offering the policy.

Why? Because there are dozens of other no exam insurance companies with better policies and much lower premiums. They take care of your family with immediate, full coverage.

You are encouraged to get quotes from an independent life insurance agent/broker to see what your best options really are. Colonial Penn is not going to tell you this. They would like to you pay “full price” for their no health question plan with the 2 year wait for full benefits.

Only an independent agent/broker can actually shop your case, free of charge and identify the best policy and pricing you qualify for. Colonial Penn cannot do this. They just sell you their 9.95 life insurance plan.

There are a lot of life insurance companies out there to consider for people 50-85. You don’t have to be in A1 health either.

It is important to note that life insurance plans that do not medically underwrite (no health questions) are offering a guaranteed acceptance whole life policy. This type of whole life insurance will accept age qualified individuals regardless of their risk classification.

Guaranteed acceptance life insurance should be used only if you cannot qualify based on your overall health history. Most people 50-85 can qualify based on their health history for full, 1st day whole life insurance which is far superior to Colonial Penn’s $9.95 plan offer and considerably more affordable.

With the Colonial Penn’s 995 life insurance, consumers are paying for all the high risk that this coverage allows. Do you have late stage cancer or a terminal illness? Do you reside in a nursing home or have a diagnosis of Dementia or Alzheimer’s?

If not, don’t assume you need “Guaranteed Acceptance” life insurance.

We’ve seen people with diabetes, a past heart attack or even stroke victims assume they can’t get a better policy.

Have you spoken to a life insurance professional that works with all the top carriers?

At this point, I would recommend that you use our instant life insurance quote tool located on this page and get some pricing. It should be on the bottom if you are on a mobile device.

If you’re in pretty decent health for your age, run yourself thru as “excellent health” and see who the top carriers of life insurance are. If you want to price out the more expensive, no health question policies like the $9.95 Colonial Penn life insurance product, run yourself thru as “poor health” on the tool. The quoting tool will lock in an apples to apples comparison.

Once you have the quote comparison numbers for the amount of coverage you need, continue further in our Colonial Penn $9.95 plan review where you will be shocked at what you didn’t know…

I’m not kidding either!

The Colonial Penn $9.95 Whole Life Insurance Policy

If you’ve scoured the internet for a Colonial Penn life insurance review, we assume you’ve found a lot of information you may already know.

What you may not know, this is a whole life insurance policy, with a limited face amount (death benefit). How can it be guaranteed? Simple…there are no medical questions, lifestyle or other common history questions used by insurers to underwrite an insurance policy. As long as you are of the right age (50-85) at application, mentally able to make application and can afford the premiums, you are eligible to buy their policy.

With whole life insurance, the price is locked for life once you make your first premium payment. The benefit amount will never go down either. However, with a guaranteed acceptance policy, there is always 2 years of limited benefits for natural causes of death. If natural death occurs during this period, your beneficiary will receive all of the premiums you paid plus 7% interest with the Colonial Penn 9.95 plan.

For example, if you bought a 10k policy with Colonial Penn, the insured will not be fully covered unless the 2 year waiting period has expired OR death occurs as the result of an accident. After 2 years have passed, the beneficiary would receive the full payout of 10K for both accidental or natural death causes.

As you can probably see, there is a great equalizer for not asking any health questions and a super easy application, right?

How do you feel about that?

This is the reality of ANY guaranteed acceptance life insurance, not just the Colonial Penn product. There are a few other companies offer this same product. All of which have no medical questions to qualify. Most are better products but not the subject of this review.

Who is this type of coverage really for then?

The 9.95 guaranteed acceptance life insurance is designed for someone 50-85 with very serious, high risk health or lifestyle, wanting to protect their loved one’s financial future and willing to accept the policy natural death limitations during the first 2 years.

These are some scenarios which suggest the insured might require a no medical question, guaranteed acceptance life insurance plan. I mentioned some specific health ailments earlier. The other is someone who just does not want to talk about their situation. It is just too personal. Enough said. That is okay if you don’t want to discuss your situation. Just understand the insurance companies will only offer limited coverage the first 2 years.

If wish to accept those terms and want no health questions asked for a guaranteed acceptance policy, you might want to compare Colonial Penn’s 9.95 plan with Gerber Guaranteed Life which will be more affordable and offer the better benefits during those first couple years. Use the quoting tool on this page and select “Poor Health” to get their price.

Now, this $9.95 per month insurance is the only life insurance policy Colonial Penn is offering in 2024. Gone are the days of their level benefit whole life policy. This is a huge business mistake they’ve made, in my opinion. Most seniors qualify for full, first day simplified issue final expense whole life insurance. Much more affordable, easy issue and better protection for your family.

Roughly 5-10% of seniors need a product like the Colonial Penn guaranteed acceptance policy.

In other words…

the other 90% would be grossly overcharged not to mention have lower benefits for 2 full years.

Do you want to worry if your family will have what they need when your time comes? How would they fair if you pass on before the policy had matured to full value?

$9.95 Colonial Penn Units

What makes Colonial Penn advertisements concerning is how they establish the premium. Not to many people buy high risk life insurance for 9.95 per month.

Their method is quite a bit different than the industry standards.

Once they have your personal info such and name, age, state and gender, you are given a cost per unit for coverage.

Each unit is $9.95.

The premium charged is fixed per unit. $9.95 is not per thousand dollars. “Unit” is the key word. If the Colonial Penn Guaranteed Acceptance policy is purchased, each unit is exactly $9.95 per month, permanently. In 2025, you can purchase up to 25 units at application for that price. Note- Colonial Penn uses the following definition: “A unit of coverage corresponds to the life insurance benefit amount you can purchase. It depends on age, gender and state.“

So, the catch with each $9.95 “unit”…

The true value of each unit varies based your risk profile which in this case is primarily your age but also your gender.

For a man, the minimum value of one “unit” is $418 while the maximum value is $2000. That is why the maximum death benefit for some individuals is $50,000 while other applicants max is $10,450.

Here is the very important key to Colonial Penn $9.95 units…

The older you are are at application, the less value 1 “unit” has. However, that one unit will still cost you $9.95 a month.

A 75 year old cannot purchase the same, maximum policy amount as a 65 year old simply due to the reduced value of the unit. It does not matter if the 65 year old was just diagnosed with internal cancer either. He/she will get more insurance than you for each $9.95 unit purchased.

Each unit is level for life with this whole life insurance policy. This means that the value of your policy will not go down during the life of the insured individual. This is consistent with all whole life insurance policies.

A female, age 60 would have a value per “unit” of $1515. You will see a reduction in available benefits as the value per “unit” decreases the older the insured is at application with the $9.95 Colonial Penn life insurance plan.

What this all means in the end is, low face amounts (death benefits) for many policy owners who are buying in their 70’s and 80’s. This of course really affects their loved ones as well.

Like all whole life insurance policies, this Colonial Penn guaranteed acceptance life policy offers a cash value account which grows over time.

This is a living benefit, an option to borrow against the policy.

However, the interest can be pretty steep and not recommended. Unpaid loans reduce the death benefit for your beneficiary(s).

I’m going to insert another disclaimer here. We do not recommend using any burial, funeral or final expense insurance policy in such a manner. This is just a policy feature of any whole life insurance policy out there.

So, premiums are set based on the number of units you purchase (up to 25 in 2025) with each unit costing $9.95.

2025 Colonial Penn Guaranteed Acceptance Whole Life – Male Rates Per Month

| AGE | 1 unit/$9.95 | 2 Units/$19.90 | 4 Units/$39.80 | 6 Units/$59.70 | 8 Units/$79.60 | 15 Units/$149.25 |

|---|---|---|---|---|---|---|

| 50 | $1,699.00 | $3,398.00 | $6,796.00 | $10,194.00 | $13,592.00 | $25,485.00 |

| 51 | $1,620.00 | $3,240.00 | $6,480.00 | $9,720.00 | $12,960.00 | $24,300.00 |

| 52 | $1,565.00 | $3,130.00 | $6,260.00 | $9,390.00 | $12,520.00 | $23,475.00 |

| 53 | $1,515.00 | $3,030.00 | $6,060.00 | $9,090.00 | $12,120.00 | $22,725.00 |

| 54 | $1,460.00 | $2,920.00 | $5,840.00 | $8,760.00 | $11,680.00 | $21,900.00 |

| 55 | $1,420.00 | $2,840.00 | $5,680.00 | $8,520.00 | $11,360.00 | $21,300.00 |

| 56 | $1,370.00 | $2,740.00 | $5,480.00 | $8,220.00 | $10,960.00 | $20,550.00 |

| 57 | $1,313.00 | $2,626.00 | $5,252.00 | $7,878.00 | $10,504.00 | $19,695.00 |

| 58 | $1,258.00 | $2,516.00 | $5,032.00 | $7,548.00 | $10,064.00 | $18,870.00 |

| 59 | $1,200.00 | $2,400.00 | $4,800.00 | $7,200.00 | $9,600.00 | $18,000.00 |

| 60 | $1,167.00 | $2,334.00 | $4,668.00 | $7,002.00 | $9,336.00 | $17,505.00 |

| 61 | $1,112.00 | $2,224.00 | $4,448.00 | $6,672.00 | $8,896.00 | $16,680.00 |

| 62 | $1,057.00 | $2,114.00 | $4,228.00 | $6,342.00 | $8,456.00 | $15,855.00 |

| 63 | $1,000.00 | $2,000.00 | $4,000.00 | $6,000.00 | $8,000.00 | $15,000.00 |

| 64 | $949.00 | $1,898.00 | $3,796.00 | $5,694.00 | $7,592.00 | $14,235.00 |

| 65 | $896.00 | $1,792.00 | $3,584.00 | $5,376.00 | $7,168.00 | $13,440.00 |

| 66 | $846.00 | $1,692.00 | $3,384.00 | $5,076.00 | $6,768.00 | $12,690.00 |

| 67 | $802.00 | $1,604.00 | $3,208.00 | $4,812.00 | $6,416.00 | $12,030.00 |

| 68 | $762.00 | $1,524.00 | $3,048.00 | $4,572.00 | $6,096.00 | $11,430.00 |

| 69 | $724.00 | $1,448.00 | $2,896.00 | $4,344.00 | $5,792.00 | $10,860.00 |

| 70 | $686.00 | $1,372.00 | $2,744.00 | $4,116.00 | $5,488.00 | $10,290.00 |

| 71 | $657.00 | $1,314.00 | $2,628.00 | $3,942.00 | $5,256.00 | $9,855.00 |

| 72 | $627.00 | $1,254.00 | $2,508.00 | $3,762.00 | $5,016.00 | $9,405.00 |

| 73 | $608.00 | $1,216.00 | $2,432.00 | $3,648.00 | $4,864.00 | $9,120.00 |

| 74 | $578.00 | $1,156.00 | $2,312.00 | $3,468.00 | $4,624.00 | $8,670.00 |

| 75 | $549.00 | $1,098.00 | $2,196.00 | $3,294.00 | $4,392.00 | $8,235.00 |

| 76 | $521.00 | $1,042.00 | $2,084.00 | $3,126.00 | $4,168.00 | $7,815.00 |

| 77 | $493.00 | $986.00 | $1,972.00 | $2,958.00 | $3,944.00 | $7,395.00 |

| 78 | $468.00 | $936.00 | $1,872.00 | $2,808.00 | $3,744.00 | $7,020.00 |

| 79 | $441.00 | $882.00 | $1,764.00 | $2,646.00 | $3,528.00 | $6,615.00 |

| 80 | $426.00 | $852.00 | $1,704.00 | $2,556.00 | $3,408.00 | $6,390.00 |

| 81 | $424.00 | $848.00 | $1,696.00 | $2,544.00 | $3,392.00 | $6,360.00 |

| 82 | $423.00 | $846.00 | $1,692.00 | $2,538.00 | $3,384.00 | $6,345.00 |

| 83 | $421.00 | $842.00 | $1,684.00 | $2,526.00 | $3,368.00 | $6,315.00 |

| 84 | $420.00 | $840.00 | $1,680.00 | $2,520.00 | $3,360.00 | $6,300.00 |

| 85 | $418.00 | $836.00 | $1,672.00 | $2,508.00 | $3,344.00 | $6,270.00 |

2025 Colonial Penn Guaranteed Acceptance Whole Life – Female Rates Per Month

| AGE | 1 Unit/$9.95 | 2 Units/$19.90 | 4 Units/$39.80 | 6 Units/$59.70 | 8 Units/$79.60 | 15 Units/$149.25 |

|---|---|---|---|---|---|---|

| 50 | $2,000 | $4,000 | $8,000 | $12,000 | $16,000 | $30,000 |

| 51 | $1,942 | $3,884 | $7,768 | $11,652 | $15,536 | $29,130 |

| 52 | $1,890 | $3,780 | $7,560 | $11,340 | $15,120 | $28,350 |

| 53 | $1,845 | $3,690 | $7,380 | $11,070 | $14,760 | $27,675 |

| 54 | $1,802 | $3,604 | $7,208 | $10,812 | $14,416 | $27,030 |

| 55 | $1,761 | $3,522 | $7,044 | $10,566 | $14,088 | $26,415 |

| 56 | $1,719 | $3,438 | $6,876 | $10,314 | $13,752 | $25,785 |

| 57 | $1,669 | $3,338 | $6,676 | $10,014 | $13,352 | $25,035 |

| 58 | $1,620 | $3,240 | $6,480 | $9,720 | $12,960 | $24,300 |

| 59 | $1,565 | $3,130 | $6,260 | $9,390 | $12,520 | $23,475 |

| 60 | $1,515 | $3,030 | $6,060 | $9,090 | $12,120 | $22,725 |

| 61 | $1,460 | $2,920 | $5,840 | $8,760 | $11,680 | $21,900 |

| 62 | $1,420 | $2,840 | $5,680 | $8,520 | $11,360 | $21,300 |

| 63 | $1,370 | $2,740 | $5,480 | $8,220 | $10,960 | $20,550 |

| 64 | $1,313 | $2,626 | $5,252 | $7,878 | $10,504 | $19,695 |

| 65 | $1,258 | $2,516 | $5,032 | $7,548 | $10,064 | $18,870 |

| 66 | $1,200 | $2,400 | $4,800 | $7,200 | $9,600 | $18,000 |

| 67 | $1,167 | $2,334 | $4,668 | $7,002 | $9,336 | $17,505 |

| 68 | $1,112 | $2,224 | $4,448 | $6,672 | $8,896 | $16,680 |

| 69 | $1,057 | $2,114 | $4,228 | $6,342 | $8,456 | $15,855 |

| 70 | $1,000 | $2,000 | $4,000 | $6,000 | $8,000 | $15,000 |

| 71 | $949 | $1,898 | $3,796 | $5,694 | $7,592 | $14,235 |

| 72 | $896 | $1,792 | $3,584 | $5,376 | $7,168 | $13,440 |

| 73 | $846 | $1,692 | $3,384 | $5,076 | $6,768 | $12,690 |

| 74 | $802 | $1,604 | $3,208 | $4,812 | $6,416 | $12,030 |

| 75 | $762 | $1,524 | $3,048 | $4,572 | $6,096 | $11,430 |

| 76 | $724 | $1,448 | $2,896 | $4,344 | $5,792 | $10,860 |

| 77 | $689 | $1,378 | $2,756 | $4,134 | $5,512 | $10,335 |

| 78 | $657 | $1,314 | $2,628 | $3,942 | $5,256 | $9,855 |

| 79 | $627 | $1,254 | $2,508 | $3,762 | $5,016 | $9,405 |

| 80 | $608 | $1,216 | $2,432 | $3,648 | $4,864 | $9,120 |

| 81 | $578 | $1,156 | $2,312 | $3,468 | $4,624 | $8,670 |

| 82 | $549 | $1,098 | $2,196 | $3,294 | $4,392 | $8,235 |

| 83 | $521 | $1,042 | $2,084 | $3,126 | $4,168 | $7,815 |

| 84 | $493 | $986 | $1,972 | $2,958 | $3,944 | $7,395 |

| 85 | $468 | $936 | $1,872 | $2,808 | $3,744 | $7,020 |

You can save some good money by paying annually on the Guaranteed Acceptance policy. This will save you the cost of one month each year if you elect to pay as such. That is a 8.3% discount each year.

The death benefit of the Colonial Penn guaranteed acceptance life insurance does NOT go down as you age nor will the premiums ever change.

Be aware that this product may not adequately fund your funeral + burial expenses if you are in your mid 70’s on up. The average full funeral cost alone nationally in 2025 is roughly $10,000+.

I’ve have been talking to many folks in Texas recently who told me that you can’t have much of a funeral for less than $10,000-$11,000 in 2023-2024.

Keep in mind what your goal is for this insurance. Could you be around another decade or two? In nearly 25 years I have seen funeral and burial costs double.

Ask yourself another question. Do I need high risk life insurance or could I could I qualify for another policy with better rates, have no exam and have no waiting period for full benefits?

From our table above, you can see 15 units would cost a 65 year old male applicant $149.25 per month with Colonial Penn 9.95 insurance. This would generate a policy value after the limited benefit period of $13,440.

A key issue with the Colonial Penn policy, the 65 year old man (example above) is only eligible to purchase a maximum policy size of $22,400 in death benefits for his loved ones with the 9.95 life insurance plan. This maximum would be based on a purchase of 25 units (max allowed) for a male age 65. While his should be adequate for a funeral and burial in most areas of the US, in 10-15 years may not leave anything else behind for other final expense needs. Carefully consider the costs in your area and assume a doubling of those costs in 20+ years.

Now, does this guaranteed product compare to the competition?

If you have read other $9.95 plan reviews, have you had the pricing of other life insurance companies that offer the same, no medical question whole life insurance? Use our instant quoting tool on this page to do your own specific comparison or simply give us a quick phone call for help.

Let’s take a quick look below at a 65 year old male.

I have access to dozens of the top life insurance carriers.

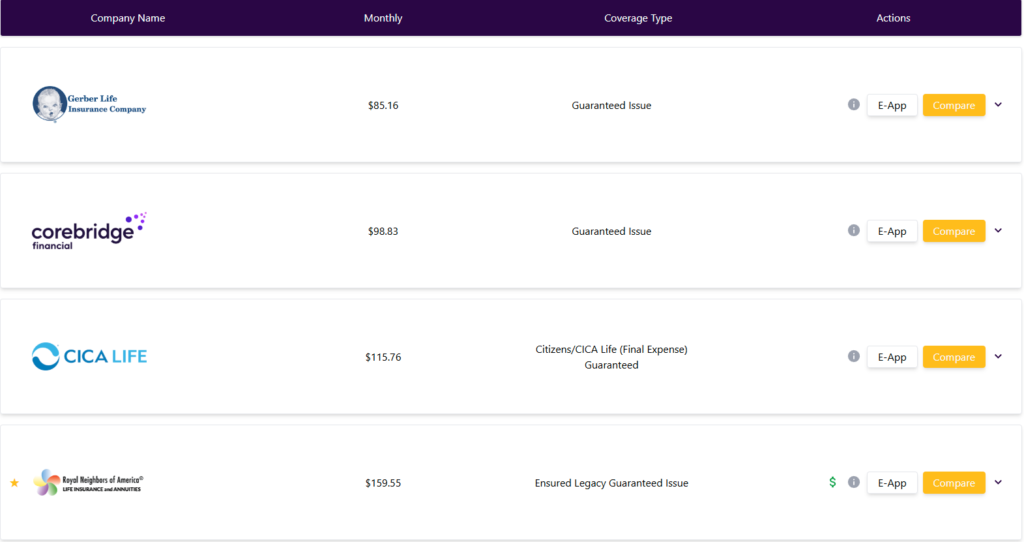

Below is a screenshot image from my computer. I ran a test case for illustration purposes only. It is a slightly larger $14,000 policy amount than the Colonial Penn 995 plan offers a man at age 65. Other than that, apples to apples comparison.

These 3 companies below offered the best rates for guaranteed acceptance whole life insurance.

For a male age 65… the best rates for guaranteed issue (no health questions).

Oh…

Please be mindful the illustration that follows directly reflects the age of a fictitious person at the time of this article updating. The date of the rates should be posted below the chart. All life insurance companies reserve the right to raise their prices prior to your application approval.

At the top, there is Gerber. Yes, the baby food company also owns a separate life insurance company. For $118.85 you get $14,000 in coverage. More benefits for your family and a much lower premium each month…for the additional protection compared to the $9.95 Colonial Penn life insurance plan.

A woman, the same age would be considerably less due to higher life expectancy of women. Again, you may use the instant quoting tool on this page if you would like to obtain an exact price for guaranteed acceptance coverage for a lady. Just be sure to select “poor health” to lock the no medical question, guaranteed acceptance plans in for comparison.

While Guaranteed Acceptance whole life insurance is typically the most expensive type of life insurance, you can clearly see Gerber or AIG are certainly easier on the pocketbook versus Colonial Penn.

All 4 of these insurance carriers allow $20,000 or more for their guaranteed issue whole life.

Check with an independent agent/broker whom has access to dozens of companies. Find out what is best for you.

9 out of 10 seniors do not purchase guaranteed acceptance whole life insurance it after speaking with us. Instead, they end up in a no exam, whole life insurance plan with full, immediate benefits that is more cost effective from the day they are accepted. This also protects their loved much more effectively.

I Have QuestionsComparing Colonial Penn’s $9.95 Insurance With The Top Carriers

Did you get a look at the Colonial Penn life insurance rates above?

If so, you probably found that their offerings are quite pricey for the benefits the policy contains.

You can find many of the top term life insurers offering much higher levels of coverage, level premiums and at a lower cost for the same period (10, 20 or even 30 years) in the case of term life insurance of course.

Renewing term is very expensive to own, particularly as a senior. Look again at the Colonial Penn term life rates posted above.

They go up roughly 30% every 5 years. That is a tremendous increase in cost over the years.

How much has it cost a policy owner in rate increases at age 75 when it expires?

Age 75 is below the average life expectancy of a man or women in the United States.

Since the medical underwriting is quite limited here, the insurer has higher risk and responds with a higher premiums. They are not able to confirm your health status very well and respond as such by adjusting the premiums to reflect that.

With that said, if you are healthy for your age, you would be best advised to look at other reputable life insurers for better options.

You can save a tremendous about of money over time by looking into getting alternative level term and premium whole life insurance elsewhere.

Medically underwritten policies are the way to go when trying to obtain term insurance if you have well managed health, even with conditions like diabetes.

Speak to a seasoned, independent life insurance specialist for help. They know the market, products and the top insurers for your specific situation.

Be aware… there are a few states in which certain Colonial Penn policies are not available.

Reaction To Colonial Penn Life Insurance Rates By Age

First, what was your overall impression of the Colonial Penn rate chart above?

Did you run a real comparison quote on our instant quote tool on this page?

If you have read a few Colonial Penn reviews, you may have learned their policy is not complicated to apply for.

Be mindful that the easier qualification is, the more expensive the product is generally going to be.

It can also mean there may be limitations built into a policy such as the 2 year waiting period with the Colonial Penn Guaranteed Issue policy.

The take home from our perspective to you…

With ease of application and no health questions comes elevated risk to any life insurer.

Without a completely clear picture of “who” they are insuring, the risk (the insured party) must be offset.

Do we have clients who purchased simplified issue and guaranteed acceptance policies from us?

Yes, quite few. However, they were not Colonial Penn policies.

If your health is not A1, for heavens sake and your wallets…give us a call and let’s talk about what you want to accomplish with your life insurance. Let us help sort out who will give you the best offer. There are a number of very fine insurance companies out there. Some you very well be very familiar with and others, less likely.

Now you can make a good, informed decision on what to buy.

Advice is free here so it doesn’t cost you a penny more!!

Get AdviceDo yourself a favor and don’t limit your options to a television commercial life insurance company.

There are numerous top shelf life insurance companies small and large to consider that forgo all the cost involved with high paid endorsers.

How this helps you…

These carriers will save you lots of hard earned money and have excellent reputations for their respective products, rates and claims payment. They will drive more value and affordability for your money.

Let a reputable independent agency like Special Risk Life Insurance who specializes in tough to insure cases shop your needs and help you find the best company and policy for you.

Believe it or not, most people have multiple options even with a health condition(s) and several medications.

No, you don’t have to pay those out of sight Colonial Penn life insurance rates.

Again, this is why you talk to an experienced professional that has access to a large portfolio of senior life insurance products and companies. Don’t get caught up in fancy television commercials selling you a less than ideal product. The policy is what is written in black and white not the contents of the commercial.

Your not going to get an unbiased consultation from Colonial Penn if you ask for advice.

Do you want to be limited to one insurance company anyway?

That is the whole point of reading Colonial Penn life insurance reviews, right? Your not sure about purchasing from them are you?

The truth is, controlled high blood pressure, high cholesterol, a heart attack a few years ago etc. are pretty common and don’t put you in a medical rate class requiring guaranteed issue life insurance.

There is a long list of medical conditions that we have been able to place in standard, 1st day, full benefit policies.

I talk with people all the time who are amazed that they do not have to have guaranteed acceptance life insurance.

How Is Guaranteed Acceptance Life Insurance Different Than Other Whole Life Insurance?

In a nutshell, it is just a type of life insurance that accepts applicants without medical underwriting. No medical questions, exams or medical checks in the decision process by the insurer.

It is the most liberal type of life insurance you can purchase as it accepts anyone regardless of their health.

It is also the most expensive type of life insurance per thousand dollars of coverage.

The design is for high risk insurance applicants who cannot be medically underwritten due to their overall health.

Guaranteed Acceptance coverage is the essence of high risk life insurance and therefore carries a price tag with it.

As shown above, this type of coverage is not exclusive to Colonial Penn and is in fact offered by a number of companies including: AIG, Gerber and AARP/New York Life.

Guaranteed acceptance products all come with a 2 or 3 year limited benefit period, without exception. This is regardless of the insurance company name.

During the limited benefit or “waiting” period, the policy will not pay your beneficiary full benefits for natural death.

Accidental death would be full benefits, but natural death should be your primary concern with advanced age.

The limited benefit period would pay a return of premium plus a percentage of interest. The interest upon death is dependent on the particular insurance company. Once that period expires, full benefits are available for natural and accidental death.

Now… Here comes the Colonial Penn restrictions…

The Colonial Penn $9.95 life insurance plan can only be purchased between ages 50-85 years of age.

Having a limited death benefit the first 2 years of ownership is sometimes known as a graded death benefit.

If death occurs due to natural causes during those first 2 years, the benefits are limited to the return of all premiums paid plus 7% interest (compounded annually) to your beneficiary.

This is weak. Most guaranteed acceptance whole life policies offer 10% during those first two years.

Now, if death occurs as the result of an accident, the full face amount (death benefit) WILL be paid out to your beneficiary during all years.

Once your first 2 years have passed, you have full coverage for natural and accidental death under this policy.

Remember, Colonial Penn is taking a big risk not medically underwriting these policies.

You may be in darn good health compared to most seniors, but they don’t know that.

You see, there are no medical questions on the application.

As such they must limit the benefits to offset some of their risk or it would naturally result in a large financial loss to the company and discontinuation of the product.

Raising the rates on Colonial Penn 9.95 life insurance and inserting a 2 year limited benefit period is their solution.

Ask a seasoned independent agent or broker for assistance to see what you would qualify for first.

Guaranteed Acceptance Life Insurance is best for individuals that have no other options for final expenses.

That is a good rule of thumb all consumers need to know.

The 9.95 Colonial Penn Rate Lock

If you’ve watched the CP ads, you have heard features that might sound unique to life insurance. Since there are no health questions, you cannot be turned down due to your health. However, they tout other “highlights” with this offering:

- You have a full 30 days to decide if you want to keep the policy

- Your rate is locked for the life of the policy…this simply means your premium will never change.

- Whole Life Insurance covers you for your “whole life.” It is permanent coverage.

Now…here is the kicker…

By law insurance companies must give you a free look period. 20-30 is normal.

Rate lock?

No, sorry it is far from unique.

All whole life insurance policies have a “rate lock.”

Certain, low quality term life offerings do not have a “rate lock.”

Our recommendation based on this…do not base your decision to purchase any life insurance product over such features.

Colonial Penn life insurance rates are very high regardless of which policy you are comparing.

There is no special offering here at all. We offer dozens of carriers with so called “rate locks.”

A Careful Look at Colonial Penn And Various Negative Reviews and Complaints

As of the last check, records from A.M. Best show a very favorable financial rating of A- with Colonial Penn.

Occasionally, there have been complaints of difficulties in filing claims after the death of the insured person. Colonial Penn does not have a wonderful record regardless of what Jonathan Lawson, Alex Trebek, Ed McMahon or the short stint of Joe Theismann alluded to.

The good seems to be overshadowed by a lot of complaints or allegations of high pressure, pushy as well as aggressive sales tactics directed at senior citizens.

The late Alex Trebek, paid Colonial Penn spokesman was criticized for representing a carrier that used such tactics.

Many seniors have felt like they were sold the wrong product. Statements indicated the coverage was not properly explained to them beforehand. I have had many people call here asking for help with their life insurance woes.

Colonial Penn has a above average complaint index filed in rather recent years according to the National Association of Insurance Commissioners (NAIC). In 2022, it exceeded 4 times the national average. This is NOT good.

This is well above average number of complaints for a life insurance company of this size. So yes, there are some negative Colonial Penn reviews out there.

I suspect most of the Colonial Penn negative reviews are related to consumers not understanding the limitations of the $9.95 life insurance product.

Without personally interviewing the folks making the majority of the complaints, I can only draw on the phone calls I’ve received for help and give you a best guess. I have a lot of people calling my office telling me that they want to buy a policy like Colonial Penn’s. Companies that push “no health question” policies seem to have a tendency towards hiding the downside of the policy they are selling.

Be careful before buying. “Popular” name brand life insurance does not equal a good policy or reasonable premiums.

Ladies and gentleman, make sure you get a good broker or independent insurance agent. Read the fine print before accepting any life insurance policy.

Many families end up very disgruntled over a policy that did not meet their needs, expired when the family really needed the coverage and/or end up costing them way more $ than necessary.

Colonial Penn $9.95 Insurance Policy – The Real Scoop

While this may be a repeat for those who have read this article to this point, many people came here to find out how much life insurance you get for $9.95 with Colonial Penn. In our Colonial Penn life insurance review, I’ve created this additional section to address the newer 9.95 plan Colonial Penn advertisement with Jonathan Lawson.

First of all, for $9.95 a month with Colonial Penn, you would own a mere 1 unit of their “Guaranteed Acceptance” policy. This is the price per unit (you may buy up to 15 units) regardless of your age. 1 unit is actually very little life insurance especially if you are in your 70’s or more and considering a policy.

The older you are as an applicant at purchase/application time, the lower in financial value you will receive for the $9.95 per unit each month.

As of 2025 you can purchase up to 25 units. This is regardless of your age. For someone in their later years and buying life insurance…well, you may not be able to buy a large enough policy to cover your final expenses and/or create the legacy for your family you want.

The unit value of what you would be paying will be determined by your age at application. If you are 60 the “unit” value will be much greater than someone who is 75.

So, how much life insurance do you get for 9.95 from Colonial Penn per month?

Not very much. See how much a policy will really cost you each month.

Colonial Penn Life Insurance For Seniors: Go Back to the Drawing Board

Our Colonial Penn life insurance review has been intended to get you all information you need including that which would not be made clear to you by calling Colonial Penn or viewing their advertisements.

There are other reviews of Colonial Penn’s $9.95 plan on other websites. I suspect we’ll have it covered it here in spades.

Be sure you understand what you are buying before you purchase any life insurance.

Whole life insurance is indeed permanent life insurance, but it still comes in different flavors.

It is absolutely imperative that you understand the specific product that you are buying whether it is from Colonial Penn or another insurer.

They can only sell you what they offer, right?

Life insurance is one of the more important decisions you’ll make in your lifetime. Colonial Penn is not offering any options to seniors at all. Most seniors can obtain not only much lower premiums on whole life insurance but first day, FULL coverage.

Always look at all the terms and conditions. Be sure to see what is not included in the benefits.

Those are…

The limitations of the policy.

At buying time, here is some advice:

- High Pressure sales tactics are absolutely wrong and unprofessional.

- Make sure all is explained to your complete satisfaction before putting your John Hancock on the line.

- Name recognition is really not something to focus on when buying life insurance. It can lead to negative consequences and even a decline on your record. What is written in the policy, the cost and the financial strength of the insurance company is more important.

I’m sure you’ll agree, you don’t want to buy the wrong product because of assumptions.

The rare exceptions are between ages 50-57 or 81-85. If you are in those age ranges and have very, very poor health and absolutely need life insurance, it may be your answer. However, it is not the best either. Outside of that, these guaranteed issue products are surpassed elsewhere, typically by Gerber Life.

I must admit that I am not a big fan of guaranteed acceptance life insurance unless it is absolutely necessary to insure someone’s life. They are “over prescribed.” These policies do leave your family at risk for 2 full years for natural death causes. They are pushed on consumers because no one regardless of their health is declined. Makes life easy for the salesperson.

Is Colonial Penn life insurance legit?

The short answer…yes.

Is Colonial Penn Life Insurance A Good Deal or Not?

Have you used on instant quoting tool on this page to get this question answered? Best way to get the truth.

Most of the people who we work with end up purchasing a first day, full benefit whole life policy. Some discovered the quoting tool, did the comparison and realized Colonial Penn is not a good value or in their best interest.

Why?

Be mindful that the more “liberal” qualification is, the more expensive the product is going to be. An application for a life insurance policy with no health questions like the Colonial Penn $9.95 life insurance is very liberal.

Traditional life insurance with an exam is going to be the way to obtain the best rates but it is not often desirable for those who want a quick, painless option and/or a smaller policy amount.

If your health is not A1, for heavens sake and your wallets…give us a call and talk about what you want to accomplish with the life insurance. Get professional assistance to assess what is best for your goals and budget.

Get the facts so you can make a good, informed decision on what company and policy is best for your needs and goals.

Advice is free here.

Nope, doesn’t cost you a penny more!!

Keep in mind, you took the time to look into our Colonial Penn life insurance review.

That is actually a good thing. Now you no what Colonial Penn 9.95 life insurance is all about.

Buy the right policy that gives you the best value for your money and takes care of those you really love.

Get AdviceDo yourself a favor… don’t limit your options to a television commercial life insurance company. There are numerous top shelf life insurance companies small and large to consider.

Many life insurance companies carriers have excellent reputations for their products, rates and claims payment. They just don’t advertise the way Colonial Penn does.

Most of them just forgo the well paid, recognizable spokesperson and drive more value and affordability with their products.

Are these no medical exam policies like the Colonial Penn options?

Yes, but these products are typically sold thru independent life insurance agents and agencies who will have a battery of different offerings to cater to those people living with very significant health conditions.

The Special Risk Life Grade For Colonial Penn Life Insurance:

Colonial Penn 9.95 Guaranteed Acceptance Life Insurance = “D”

At Special Risk Life, we find about 90% of our clients can qualify for no exam, level benefit whole life insurance. Again, that is why you talk to an experienced professional that has access to a large portfolio of senior life insurance products.

Your not going to get an unbiased consultation from Colonial Penn if you ask for advice. Think about it.

Do you really want to be limited to one insurance company anyway?

That is the whole point of reading Colonial Penn life insurance reviews, right?

Your not sure about purchasing from them or not.

The truth is, controlled high blood pressure, high cholesterol are pretty common and don’t generally put you in a high risk life insurance class.

Maybe you had a heart attack in recent years.

There is a long list of medical conditions that we have been able to place in standard, full benefit whole life insurance policies from the get go.

I talk with people all the time who are amazed that they do not have to have guaranteed acceptance life insurance because they have less than perfect health.

Many were very happy to be able to buy more coverage for less money while better protecting their loved ones.

Folks, that is why you take the time to talk to a knowledgeable consultant. While there are resources on this website that will educate you, it is sometimes hard to apply it to oneself. Every insurance company will look at you different.

Wrapping Up Our Colonial Penn Life Insurance Review

I do not like the pricing of the the Colonial Penn $9.95 life insurance plan. Pricing is a per unit cost. The unit is variable in its value depending how old the insured is at application time. This type of marketing seems a bit shady in my mind. This is unconventional pricing and it confuses consumers into calling Colonial Penn thinking it is a great deal. These little gimmicks only garner negative reviews of Colonial Penn though they still get plenty of phone calls daily.

Final Comments And Conclusion

Let a reputable independent agent that specializes in tough to insure cases shop your needs and help you find the best company and coverage for you. Can’t tell you how many people have I’ve spoken to who thought no one would take them because they were overweight, had diabetes, had heart surgery in the past, were on lots of medications etc and just assumed they could not get a better policy.

Many folks believe they are high risk life insurance candidates and purchase guaranteed acceptance life insurance, accept the reduced benefits and much higher costs…just because they did not know better.

“Guaranteed Acceptance” may sound “wonderful” especially if you have pre-existing conditions until you discover what $9.95 per unit buys you each month. Don’t forget the potential consequences to your family in the first 2 years. Always remember the limitations of the 9.95 life insurance policy from Colonial Penn.

Folks, always try to qualify for level benefits first. No exam, some simple health history questions designed around a person 50-85 and in less than perfect health. You will end up with better coverage and a much lower cost of ownership.

Taking the time to do your due diligence and reading Colonial Penn reviews should paint you a clear picture… if it is written by a seasoned professional anyway.

Check out this article on funeral and burial insurance to get a better understanding of what type of policy you are really looking for.

If you need guaranteed issue life insurance because you can’t qualify for “no exam” level coverage otherwise, you should read this review article regarding Gerber guaranteed acceptance coverage.

Gerber Life is very, very competitive if you cannot qualify based on health questions and will save you good money when compared with other guaranteed issue policies.

With that said, you should always try to qualify for medically underwritten coverage first.

Yes, medically underwritten, no medical exam coverage is available with full, immediate benefits upon acceptance and at a considerably lower cost even if you may have your share of medical troubles.

Colonial Penn rates are not the best at all regardless of the policy.

Is Colonial Penn a top life insurance company?

Honestly, I’m not seeing it. In terms of marketing “savvy” they fair very well, but at the end of the day when your beneficiary may really need money for your final expenses, your family will not be better off.

Marketing advertisements and “savvy” does not pay death claims or make it easy on your pocketbook.

What really matters is your loved one’s are promptly taken care of and affordability, right?

Hope our Colonial Penn life insurance review was helpful and insightful for you.

Comments or questions are always welcome below.

Feel free to call us at 269-230-3464 with any questions.

Special Risk Life is a veteran independent life insurance agency that specializes in guiding people with even the toughest health conditions thru the life insurance process. We are very passionate about helping people get the financial protection they want while delivering affordable coverage people can absolutely count on.